texas estate tax rate

The tax rate ranges from 116 to 12 for 2022. Austin TX Sales Tax Rate.

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

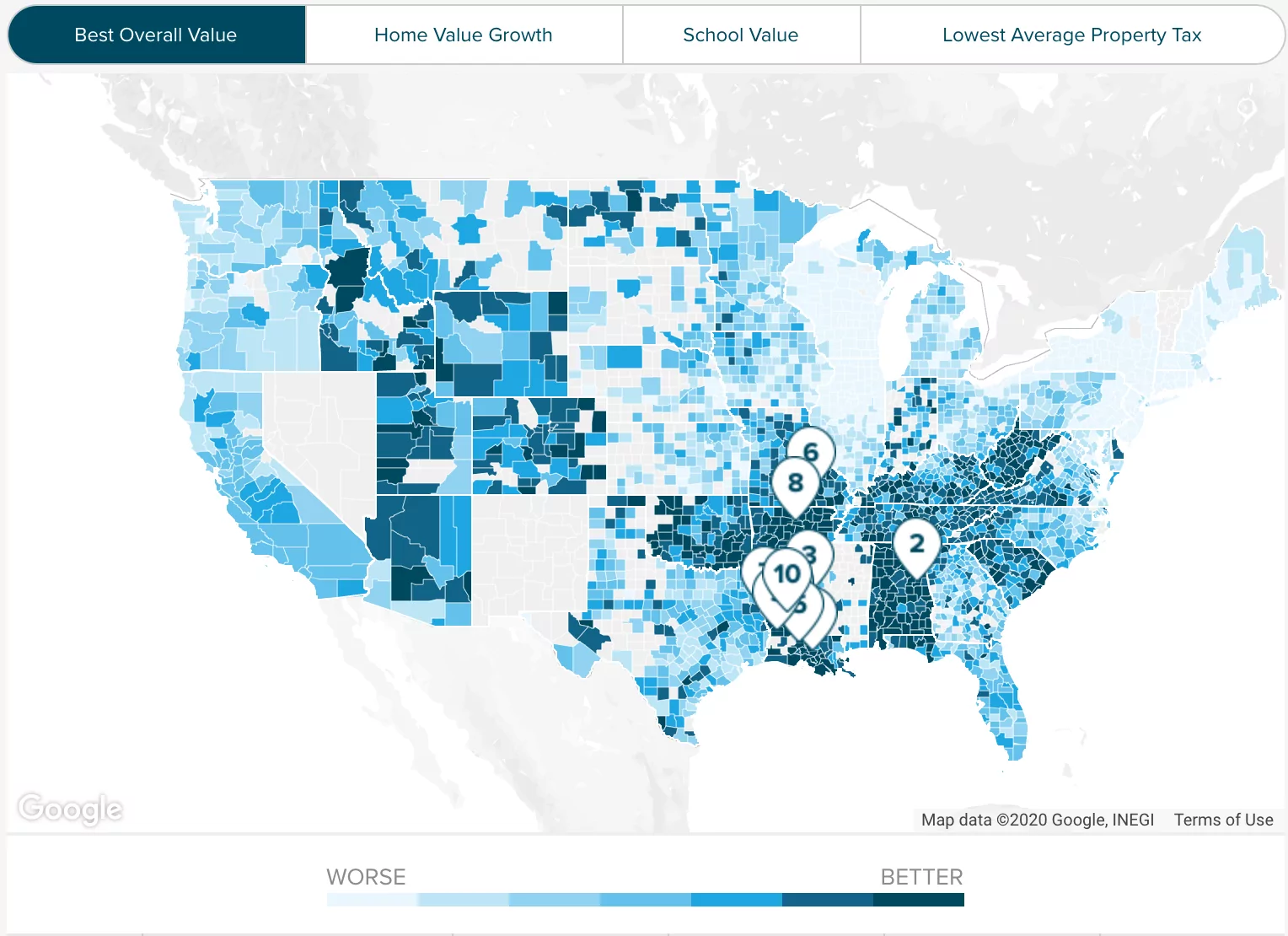

The average property tax rate in Texas is 180.

. Breaking this out in dollars if your home is valued at 200000 your personal property taxes at the average rate of 180 would be 3600 for the year. We update this information along with the city county and special district rates and levies by August. The estate tax exemption is adjusted for inflation every year.

Even then taxes can only be deferred so long as you reside in the property. No estate tax or inheritance tax. No estate tax or inheritance tax.

The federal estate tax exemption for 2022 is 1206 million. The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. Texas Comptroller of Public Accounts.

Imagine your family was based in Texas but youre inheriting. The Texas estate tax system is a pick-up tax which means that TX picks up the credit for state death taxes on the federal estate tax return. All property not exempted has to be taxed equally and consistently at present-day market worth.

1 Any funds after. The estate tax sometimes also called the death tax is a tax thats levied on the transfer of a deceased persons assets. To find detailed property tax statistics for any county in Texas click the countys name in the data table above.

Amarillo TX Sales Tax Rate. Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes. Yet any assessed penalties interest approximately 8 and other associated charges on back taxes remain in effect.

The state sales tax rate in Texas is 625 percent. Starting in 2023 it will be a 12 fixed rate. Abilene TX Sales Tax Rate.

For tax year 2021 Benbrook maintains a property tax rate of 6175 cents per 100 valuation. This data is based on a 5-year study of median property tax rates on owner-occupied homes in Texas conducted from 2006 through 2010. The latest sales tax rates for cities in Texas TX state.

School tax rates dropped by 13 since the bills passed in 2019 but taxable property values rose by 23 according to the study. In 2022 the federal estate tax. 2020 rates included for use while preparing your income tax deduction.

The top estate tax rate is 20 percent exemption threshold. Use the directory below to find your local countys Truth in Taxation website and better understand your property tax rate. Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year.

The budgets adopted by taxing units and the tax rates they set to fund those budgets play a significant role in determining the amount of taxes each property owner pays. We publish school district tax rate and levy information in conjunction with publishing the School District Property Value Study SDPVS preliminary findings which must be certified to the commissioner of education prior to Feb. Anything over these amounts will be taxed at a rate of 40.

Married couples can shield up to 2412 million together tax-free. Learn about Texas property taxes 4CCCE3C8-C54F-4BB6-AE6D-FF81FD0CDE953x. Localities can add their own sales taxes on top of this however which can bring the rate up to as much as 825 in some areas.

This is currently the seventh-highest rate in the United States. The top estate tax rate is 16 percent exemption threshold. And to find the amount due the fair market values of all the decedents assets as of death are added up.

But in TX this credit is no longer included on the federal estate-tax return. The 2021 tax year limit or the amount limit in 2022 after adjusting for inflation is 1206 million up from 117 million in 2021. No estate tax or inheritance tax.

As of 2022 if an individual leaves less than 1206 million to their heirs they wont have to worry about paying any federal estate tax in the US. This means that the state does not have an inheritance or an. The size of the estate tax exemption meant that a mere 01 of.

Take a look at the table below. No estate tax or inheritance tax. The other main thing that you should be careful of is the laws in other states.

Of all the states Connecticut has the highest exemption amount of 91 million. Arlington TX Sales Tax Rate. This means that any estates that are valued over 117 million dollars will be taxed before any assets are transferred to the heirs.

Rates include state county and city taxes. Proper communication of any levy increase is another requirement. Beaumont TX Sales Tax.

In 2019 the Texas Legislature passed legislation to help Texans better understand tax rates in their home county. The state also offers sales tax holidays each year. The estate tax rate is based on the value of the decedents entire taxable estate.

Unprepared food prescription drugs and over-the-counter drugs are exempt from sales tax. Property taxes in Texas are calculated based on the county you live in. To start you must secure a Homestead Exemption before a property tax payment suspension can even be claimed.

Property Tax Transparency in Texas. A citys property tax provisions must conform with Texas constitutional rules and regulations. Texass state-level sales tax is 625.

All property taxes are collected by the Tarrant County Tax AssessorCollectorAll property appraisals including mineral appraisals are conducted by the Tarrant Appraisal DistrictThe Attorney General of Texas has prepared a Landowners Bill of Rights which outlines the rights of. The estate tax is a tax on an individuals right to transfer property upon your death. While Texas doesnt have an estate tax the federal government does.

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

How Do State And Local Individual Income Taxes Work Tax Policy Center

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Taxes On Inherited Wealth Center On Budget And Policy Priorities

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

States With The Highest And Lowest Property Taxes Property Tax Tax High Low

Tarrant County Tx Property Tax Calculator Smartasset

Don T Die In Nebraska How The County Inheritance Tax Works

Texas Retirement Tax Friendliness Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Do State And Local Sales Taxes Work Tax Policy Center

Texas Inheritance Laws What You Should Know Smartasset

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Why Are Texas Property Taxes So High Home Tax Solutions